This past week, our esteemed Secretary of the Treasury, Janet Yellen, made a remarkable declaration. Not only did she affirm that we can afford to wage multiple wars (in Ukraine and Israel), but she also had the audacity to proclaim that the "American economy is doing extremely well." Such a claim is hard for many, including me, to accept. I'm not alone in this sentiment, and even the publicly available government financial data seems to tell a different story.

Check out these sources for a clearer picture:

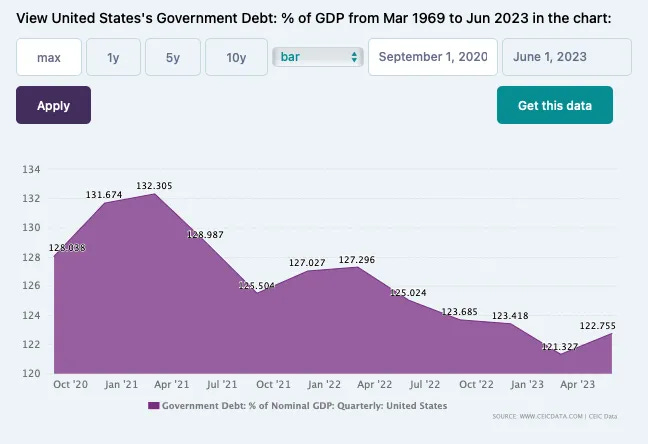

Without delving into the specifics, the central question I'm grappling with is whether they are being forthright with us. Are our leaders honestly sharing the gravity of our situation? Publicly available data, such as the Debt to GDP ratio, raises doubts.

This chart illustrates our debt amount (borrowed or printed) compared to our Gross Domestic Product (GDP). It's a leverage ratio that expresses how much our nation's operations or assets are financed with borrowed funds. For context, if I have a proven track record of earning $1,000, I can borrow a certain percentage of that to invest or deploy, called leverage. This relationship is measured in a ratio format. Depending on who you are and what you are doing, the allowed leverage ratio may vary.

As you can see, it's quite rare for a leverage ratio to exceed 1:1 (expressed as 100%). Very few industries are permitted to finance their total revenue, assets, or equity through borrowing. If, for example, I'm in the automotive industry with $1,000,000 in revenue or assets, I can borrow $500,000 for expansion. In this case, I'd have a $500,000 debt, expressed as 0.5:1 or 50% debt to equity. The higher the ratio, the riskier the investment, while a lower ratio signifies a safer investment.

When Janet was asked, given our current fiscal position with a Debt to GDP ratio of 123%, can we afford another war, she confidently answered, "YES! We can afford two wars, whatever it takes to support Israel and Ukraine." In fact, she appeared ready to greenlight as many wars as needed. Should her response not raise concerns about her judgment? A 123% leveraged position is considered high-risk in financial terms, and the cost of funding wars would only add to this risk. Furthermore, to claim that our position is "EXTREMELY WELL" seems at best disingenuous, if not a complete gaslight. The fact that she made this assertion is genuinely concerning.

Reflecting on her past claims...

Would our leaders say anything to avoid raising suspicion and deflect our attention? Should we remain vigilant and engaged in these matters? These are crucial questions each of us should be asking ourselves.

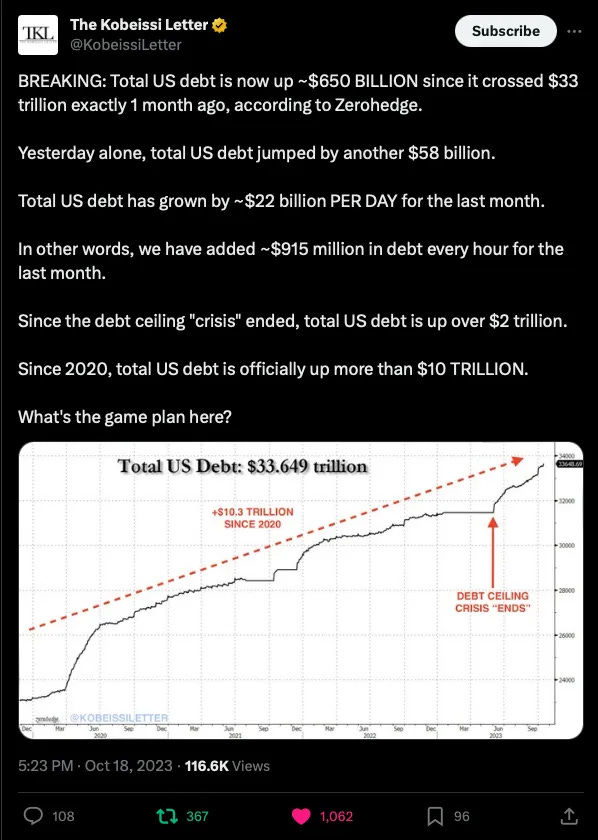

Considering the rate at which our debt is accumulating ($915 million per hour), it should give us pause. How frequently should we continue to borrow? Every day? The DebtClock offers a real-time demonstration of the mounting debt: month by month, week by week, day by day, hour by hour, minute by minute, and even second by second. The "needle" is continuously moving upward. In the context of a rocket ship ascending into space, if the elevation continued to rise second by second, questions about our destination would naturally arise. The situation is akin to being in a submarine: at what point do we hit the ocean floor? All these are valid concerns and questions.

I cannot provide definitive answers to these questions and concerns. Given the magnitude of recent crises over the past three years and the growing economic decline, I find it challenging to trust that the "grown-ups" are steering the ship. Is it plausible that their actions and decisions are uncoordinated? Or is it more likely that they are simply clueless about what they are doing? It's worth noting that our current Federal Reserve Chairman does not even hold a degree in economics; he's a lawyer. The economic state of our country is deteriorating, and the debt needle is rising rapidly.

In the words of Napoleon Bonaparte, "Never attribute to malice that which is adequately explained by stupidity."

It's certainly something to consider.